owner's draw vs salary uk

This mean putting yourself on your companys payroll. Its the amount an owner invested and profits that the business made thanks to the investment.

Do You Know It S Important For You To Decide How To Pay Yourself As A Business Owner These Ti Personal Financial Statement Business Owner Small Business Owner

Salaries paid are tax deductible for your company reducing its profits and taxable income and therefore the amount of company tax it pays.

. Directors of owner-managed companies often draw low levels of salary typically between 7500 and 9500 per annum. 64 09 358 5656. This is called a draw.

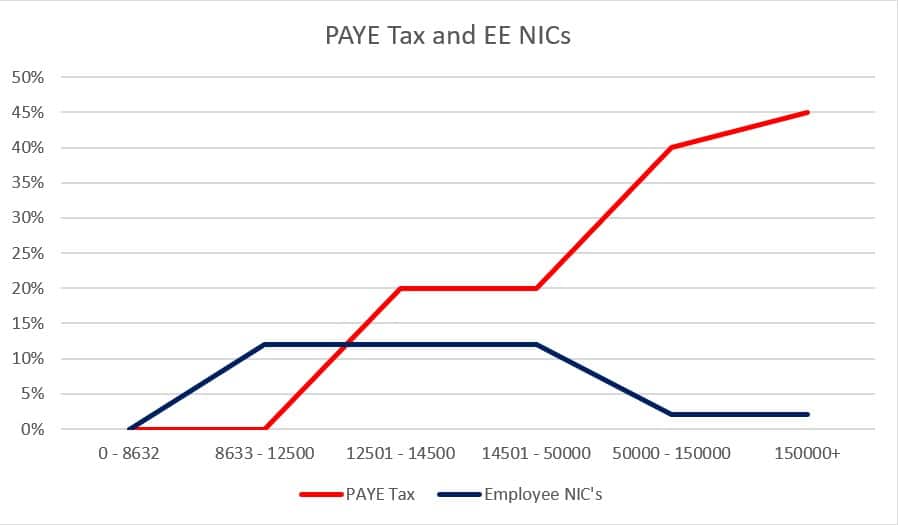

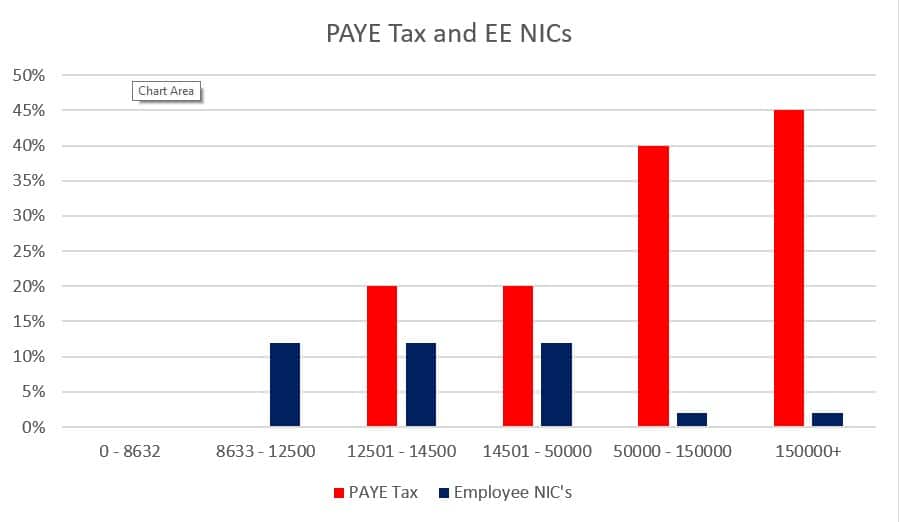

The National Insurance rate for employees is 12 between 8632 and 50024 and 2 above this figure. If he earns less than the draw amount he does not keep any commission. If an individual invests 30000 into a business entity and their share of profit is 18000 then their owners equity is at 48000.

At year-end credit the Owners Drawing account to close it for the year and transfer the balance with a debit to the Owners Equity account. This allowance is in addition to the tax-free personal allowance of 12570 for the 202223 tax year. UK tax-free dividend allowance.

Heres a high-level look at the difference between a. Salary and Bonuses. A draw is an amount of money the employee receives for a given month before his monthly sales figures are calculated.

Any dividends income falling in the higher rate band currently from 32001 to 150000 attracts the 325 higher rate of tax. There are several benefits of taking part of your income as salary. The account in which the draws are recorded is a contra owners capital account or contra owners equity account since its debit balance is contrary to the normal credit balance of the owners equity or capital account.

Drawings are made by sole traders from their business accounts and are seen as the sole traders personal income. As a company owner should you pay yourself a salary or drawings. If you draw 30000 then your owners equity goes down to 45000.

You pay yourself a regular salary just as you would an employee of the company. The reason for this is because a salary attracts a National Insurance levy. An owners draw also called a draw is when a business owner takes funds out of their business for personal use.

Owners draws are withdrawals of a sole proprietorships cash or other assets made by the owner for the owners personal use. It is an accounting transaction and it doesnt show up on the owners tax return. Wages are seen as an allowable business expense and are tax-deductible.

Salary is direct compensation while a draw is a loan to be repaid out of future earnings. There are pros and cons to both and we examine the issues. Then any dividends in excess of 150000 are subject to a rate of 381.

When choosing owners draw. The benefits of taking a salary. A draw is usually smaller than the commission potential and any excess commission over the draw payback is extra income to the employee with no limits on higher earning potential.

Owners draw There are two main ways to pay yourself as a business owner. The UKs tax-free dividend allowance for both the 202122 and 202223 tax years is 2000. All wages need to be calculated and recorded through PAYE.

Owners equity is made up of different funds including money youve. At the time of the distribution of funds to an owner debit the Owners Drawing account and credit the Cash in Bank account. A partners distribution or distributive share on the other hand must be recorded using Schedule K-1 as noted above and it shows up on the owners tax return.

Youll pay tax on dividends you receive over 2000 - the tax-free Dividend Tax Allowance at the following rates. Ways to pay yourself. If the company has already paid tax and franking credits on the dividend are.

Owners draws are usually taken from your owners equity account. After the employees sales figures for the month are calculated the employee may keep any amount of commission he earns that exceeds the draw amount. Taking a salary from your company.

Crucially dividends do not attract employer NICs. There are two journal entries for Owners Drawing account. Business owners might use a draw for compensation versus paying themselves a salary.

Thats a very common question were asked and like most tax questions the answer is not cut and dried. As a director its a good idea to take at least a small salary. An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary.

A sole proprietor or single-member LLC owner can draw money out of the business. Suppose the owner draws 20000 then the owners equity is reduced to 28000. Salary is fixed and higher earning potential comes only.

As well as a tax-free personal allowance there is a tax-free dividend allowance for dividend income. Because their personal finances and business finances are so closely linked sole traders can make. All business owners ask whether they should pay themselves a salary or drawings.

You build up qualifying years towards your state pension. 325 on dividend income within the higher rate band. 75 on dividend income within the basic rate band.

Dividends paid by a company to a shareholder out of after-tax profits are taxable for that shareholder.

Pakistan Air Force Ranks And Salary

Zinger Model David Zinger Employee Engagement Speaker Employee Engagement Employee Engagement Model Engagement Quotes

Business Operations Archives Leadership Girl Business Owner Business Sales And Marketing Strategy

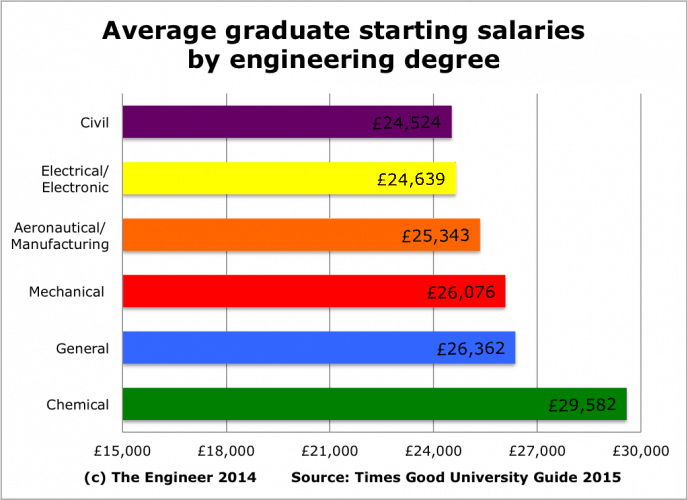

The Myth Of Engineering Low Pay

Monopoly Junior Game For 2 To 4 Players Board Game For Kids Ages 5 And Up Walmart Com Board Games For Kids Monopoly Games For Kids

Salary Vs Dividends Which Is Best 2020 21 Fusion Accountants

Privacy Policy For Influencers Bloggers And Online Business Owners In 2020 Online Business Business Owner Privacy Policy

Costum Internship Email Template Doc Sample Email Templates Advertising Strategies Email Marketing Strategy

Also Interesting Men Vs Women Man Vs Infographic

Salary Vs Dividends Which Is Best 2020 21 Fusion Accountants

Payroll Domain Payroll Payday App Financial

Incentive Plan Template Beautiful Employee Bonus Plan Template Uk Templates Resume Incentives For Employees How To Plan Free Word Document

Why Are Salaries In The Uk Europe So Low Is The Cost Of Living Generally Lower Than The Us Quora

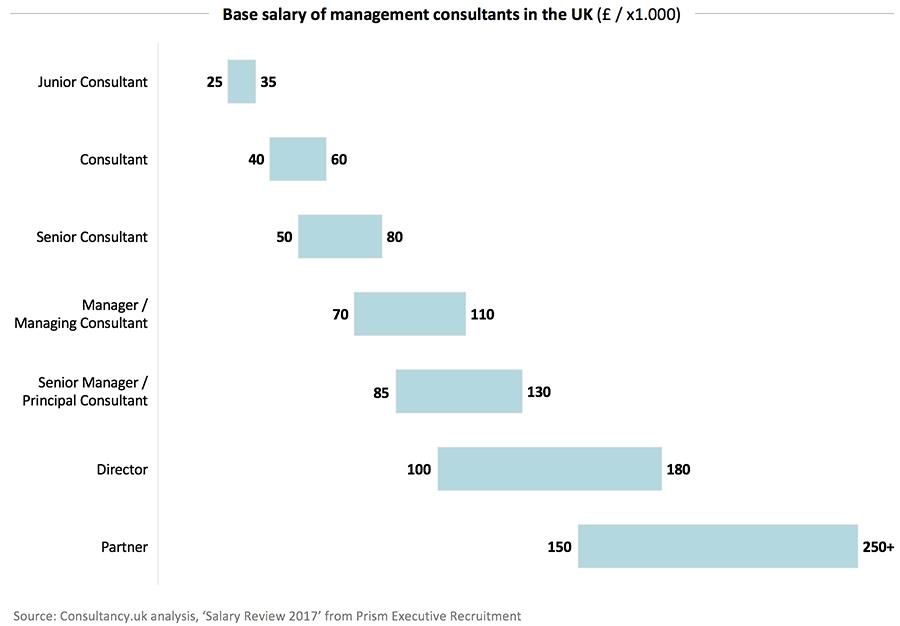

The Salary Of Consultants In The Uk Consulting Industry

Corgi Mum Dog Keyring Mothers Day Gift Corgi Gifthand Etsy Uk

Business Owner Salary Vs Owner S Draw How To Pay Yourself As A Business Owner Quickbooks Uk

Payslip Template For Excel And Google Sheets Templates Excel Templates Excel